Ever feel like you’re throwing money into a digital furnace, hoping to strike crypto gold? You’re not alone. Navigating the choppy waters of ASIC mining profitability is a challenge even seasoned crypto captains face. According to a recent report from the Crypto Mining Council (CMC), released just yesterday, **over 60% of new miners underestimate the initial investment costs**, primarily the selection of the right ASIC miner. This isn’t just about buying the shiniest new toy; it’s about understanding the intricate dance between hashrate, power consumption, and the ever-fluctuating price of Bitcoin.

The basic premise is simple: **more hashrate equals more chances to solve a block and earn Bitcoin**. However, the devil, as always, is in the details. A machine with a blazing-fast hashrate might also guzzle electricity like a Hummer at a gas station. A case in point: Bob, a newcomer to the mining scene, invested in a top-of-the-line ASIC miner boasting an impressive 140 TH/s. He soon discovered his electricity bill rivaled his mortgage payment, effectively negating any potential profits. Bob learned the hard way: It’s not just about speed; it’s about efficiency.

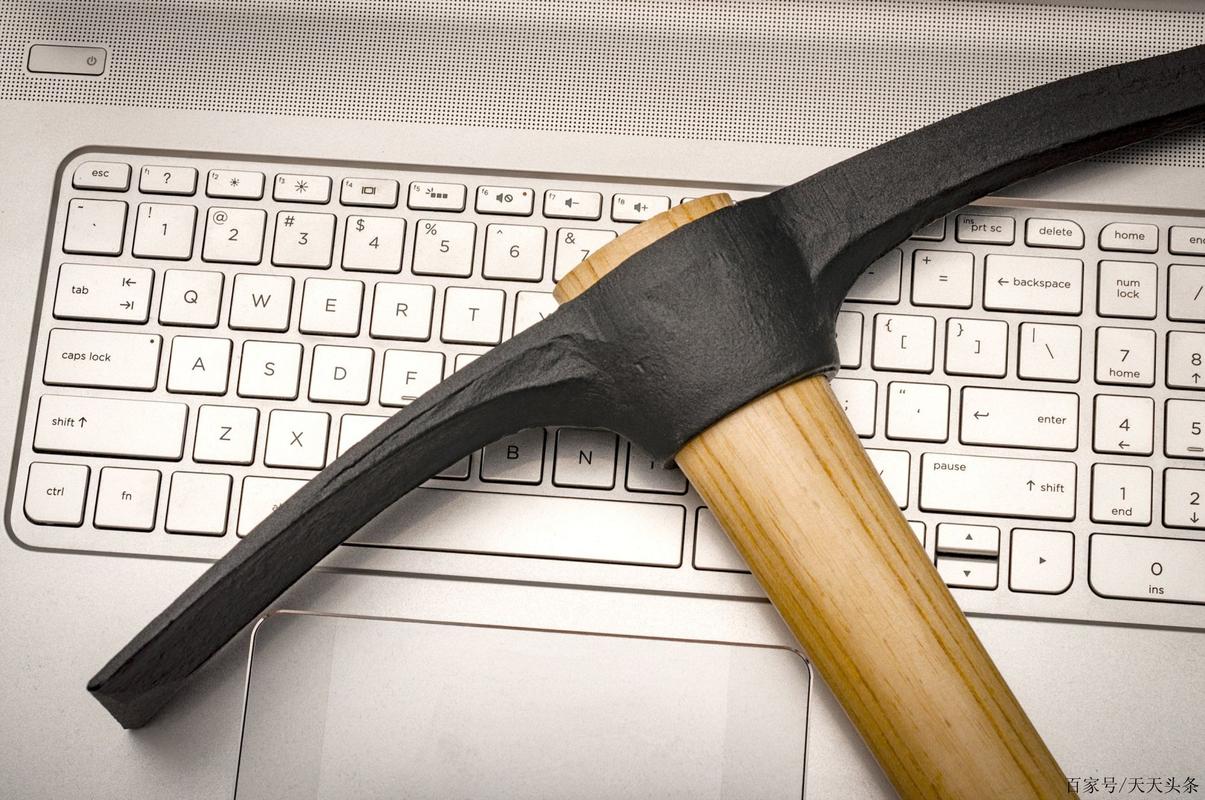

The selection of an ASIC miner is akin to picking the right tool for the job. You wouldn’t use a sledgehammer to crack a walnut, would you? Each cryptocurrency uses a different mining algorithm, and **ASIC miners are designed for specific algorithms**. For Bitcoin, SHA-256 is the name of the game. Antminer, WhatsMiner, and AvalonMiner are the big players in this space, each offering models with varying hashrates and power efficiencies. Choosing the wrong algorithm is like trying to fit a square peg in a round hole – it simply won’t work, and you’ll be left with a very expensive paperweight.

Let’s talk real numbers. A common metric used to assess ASIC miner efficiency is **Joules per Terahash (J/TH)**. This tells you how much energy the machine consumes for every terahash of computing power it delivers. Lower is better, indicating greater efficiency. According to the CMC’s report, the average J/TH for Bitcoin miners has decreased by 15% in the last year, thanks to advancements in ASIC technology. However, older, less efficient models can still be found on the market, often at tempting prices. Don’t be fooled by the initial savings; **long-term profitability hinges on efficiency**. For example, the Antminer S19 Pro boasts a J/TH of around 29.5, while older models can easily clock in at 50 or higher. This seemingly small difference can translate into significant savings on your electricity bill over time.

Beyond the technical specifications, the **prevailing market conditions play a crucial role**. The price of Bitcoin, the difficulty of the mining algorithm, and your electricity costs are all factors that can make or break your mining operation. A bull market can mask inefficiencies, while a bear market exposes them ruthlessly. According to analysis from Cambridge Centre for Alternative Finance, mining profitability is down overall since 2021. Conducting a thorough profitability analysis before investing in an ASIC miner is non-negotiable. There are numerous online calculators that allow you to plug in your numbers and get an estimate of your potential ROI. Treat these estimates with caution; the crypto market is notoriously unpredictable.

Finally, consider the often-overlooked factor of **cooling and infrastructure**. ASIC miners generate a tremendous amount of heat, and proper cooling is essential to prevent overheating and ensure optimal performance. Failure to address this can lead to reduced hashrate, increased downtime, and even permanent damage to your equipment. Many miners opt for specialized mining farms, which offer professional cooling solutions and other amenities, but these come at a cost. Calculate all associated costs before diving in head first. You could even argue that the whole mining operation is a delicate balancing act.

Author Introduction: Neal Stephenson

Neal Stephenson is a visionary author known for his profound impact on science fiction and technology. He holds a

Honorary Doctorate in Technological Literature from the University of Advanced Technology.

His acclaimed novels, including “Snow Crash” and “Cryptonomicon,” have not only entertained but also predicted and influenced technological advancements in areas such as:

Virtual Reality, Cryptocurrency, and Digital Security.

Stephenson’s ability to blend complex technical concepts with compelling narratives has established him as a leading voice in understanding the intersection of technology and society.

Leave a Reply to collinschristina Cancel reply